How to Use PayCycle

Step-by-step guides to help you master your money, paycheck by paycheck

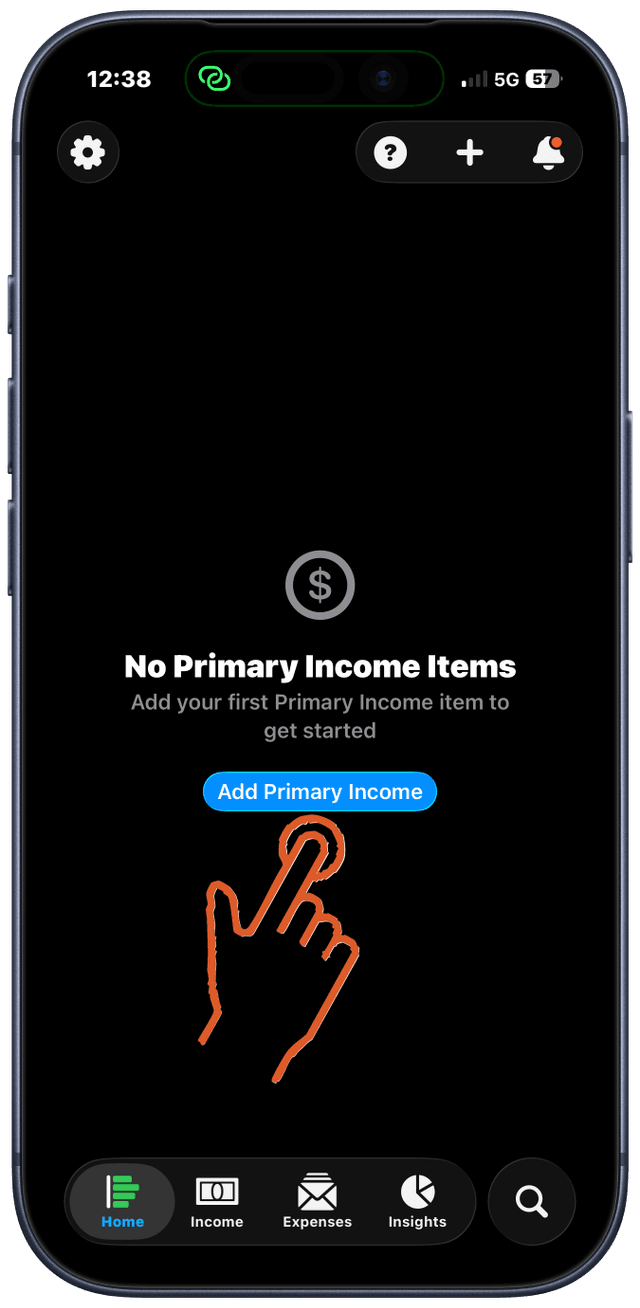

Adding Your First Primary Income

Primary income is required to generate pay periods and view transactions on the home screen.

Open PayCycle to the Home screen

Tap "Add Primary Income" button

The form opens with "Primary" automatically marked

Enter your income amount

Select your pay schedule

Weekly, bi-weekly, semi-monthly, monthly, etc.

Choose a category and add a name (optional)

Tap "Save"

Without primary income, the home screen will remain empty. At least one income source must be marked as primary.

Tips

- Mark your main paycheck as primary to track your actual pay periods

- You can add multiple primary income sources for more detailed period tracking

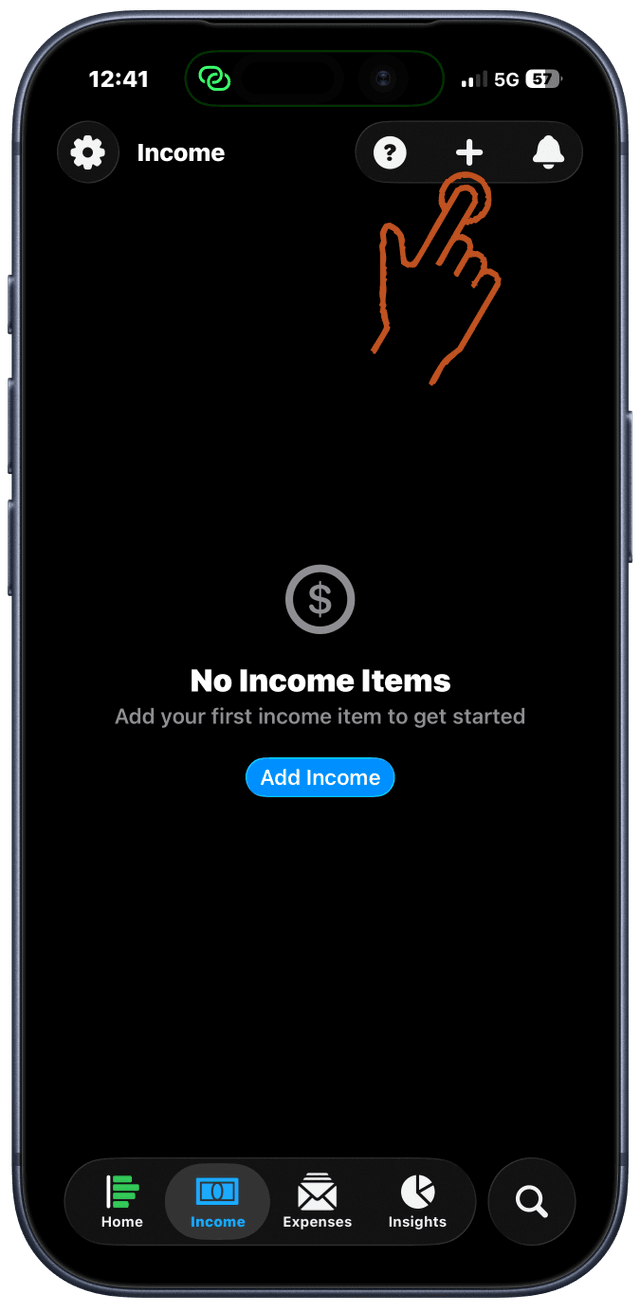

Adding Additional Income

Add side gigs, freelance work, or other income sources.

Tap the Income tab at the bottom

Tap the "+" button

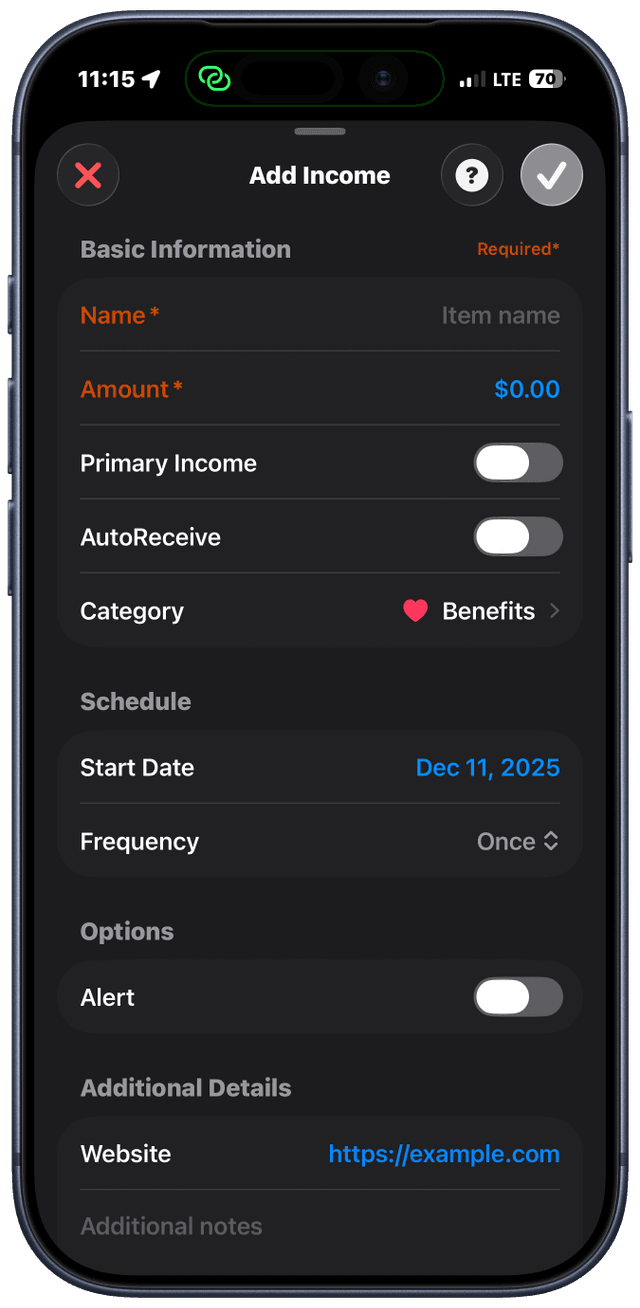

Fill in the income details

Choose whether to mark as "Primary"

Primary income defines pay periods

Set up alerts (optional)

Choose up to 2 reminder times

Enable "Auto Receipt" for predictable income

Tap "Save"

Tips

- Enable variable amounts for income that changes (tips, bonuses, etc.)

- Swipe left on any income item for quick edit/delete actions

Adding Expenses

Track bills, subscriptions, and recurring expenses.

Tap the Expenses tab at the bottom

Tap the "+" button

Enter expense amount and name

Set the due date

Choose recurrence schedule

Once, weekly, monthly, quarterly, yearly, etc.

Select a category

Set up alerts (optional)

Day of, day before, 2-3 days before, week before, etc.

Enable "Auto Payment" for bills paid automatically

Tips

- Use variable amounts for utilities that change each month

- Set reminders to never miss a payment

- Expenses automatically appear in the correct pay period based on due date

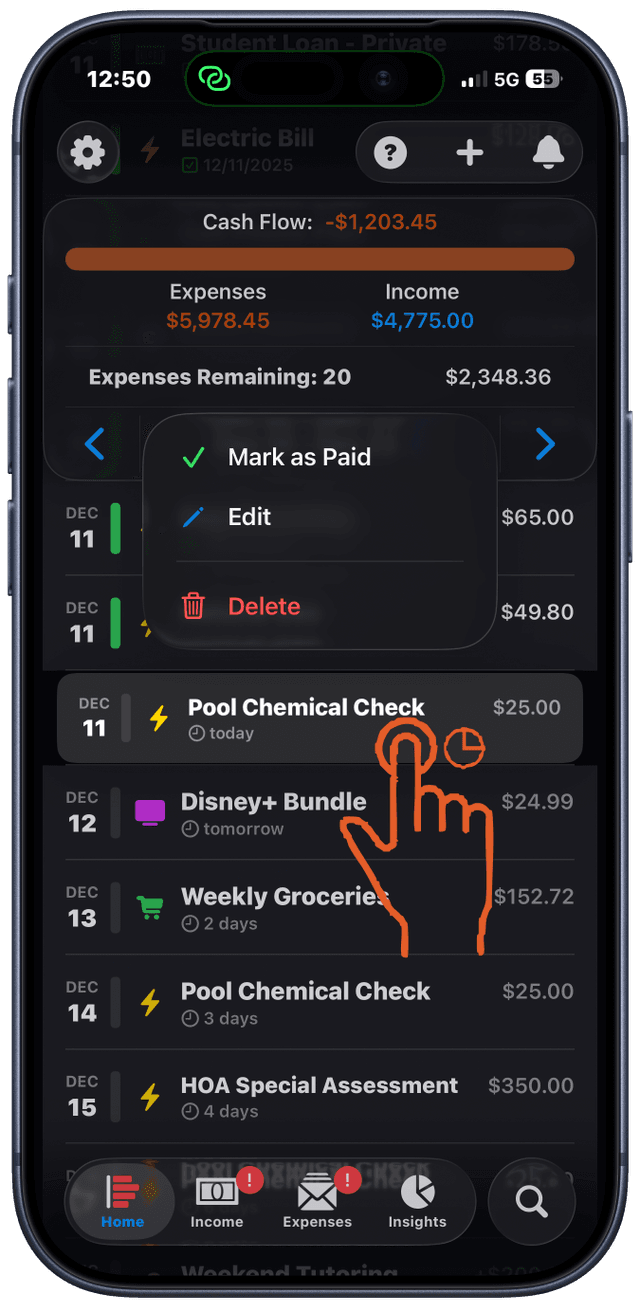

Marking Items as Paid/Received

Keep your cash flow accurate by marking transactions as complete.

Find the transaction on the Home screen

Swipe left on the item

Tap "Mark as Paid" (or "Mark as Received" for income)

The item turns green and your cash flow updates automatically

Tips

- Tap into an item to mark it from the summary view

- Green items are paid, red items are overdue, blue items are partial payments in progress

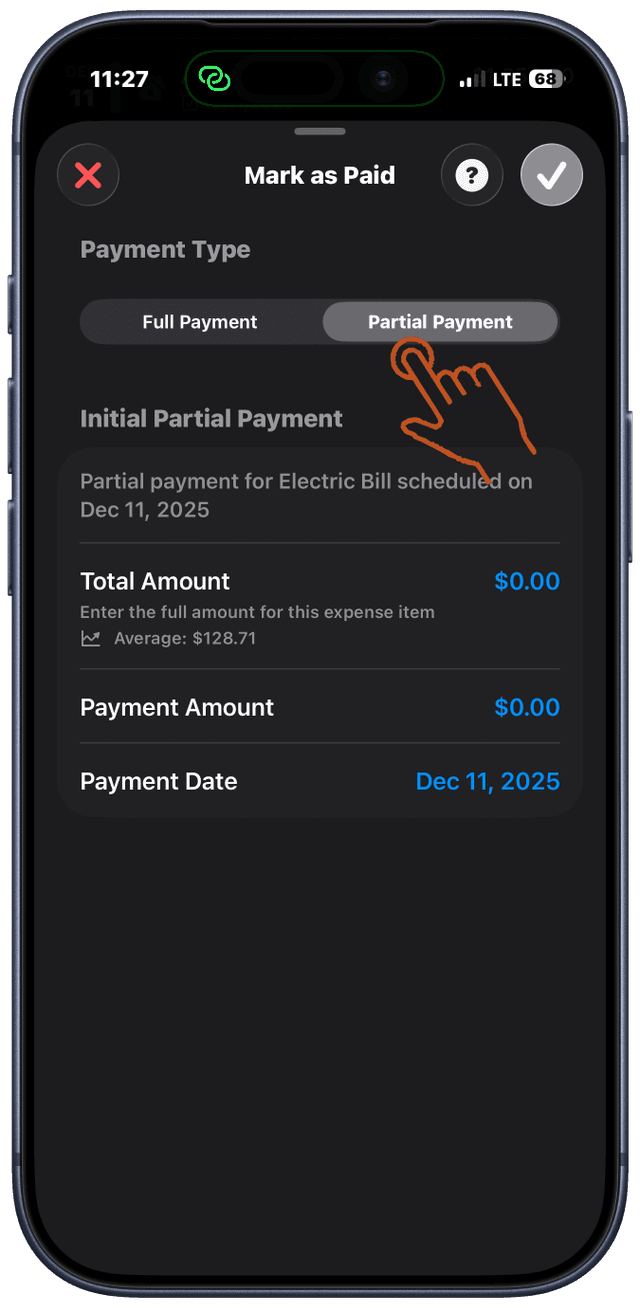

Setting Up Partial Payments

Split large bills across multiple paychecks when money is tight.

After selcting the Mark as Paid/Received button

Toggle on "Partial Payment"

Fill out the required inputs and save

When ready to make/receive another payment, tap the item

Tap "Add Payment"

Enter the amount you're paying

Track your progress with the visual progress bar

Tips

- Perfect for rent, car payments, or any large expense

- Progress bar shows how much you've paid and what's left

- Each payment is tracked individually in the period it occured, unpaid balances that are upcoming or overdue stay in the current or upcoming period

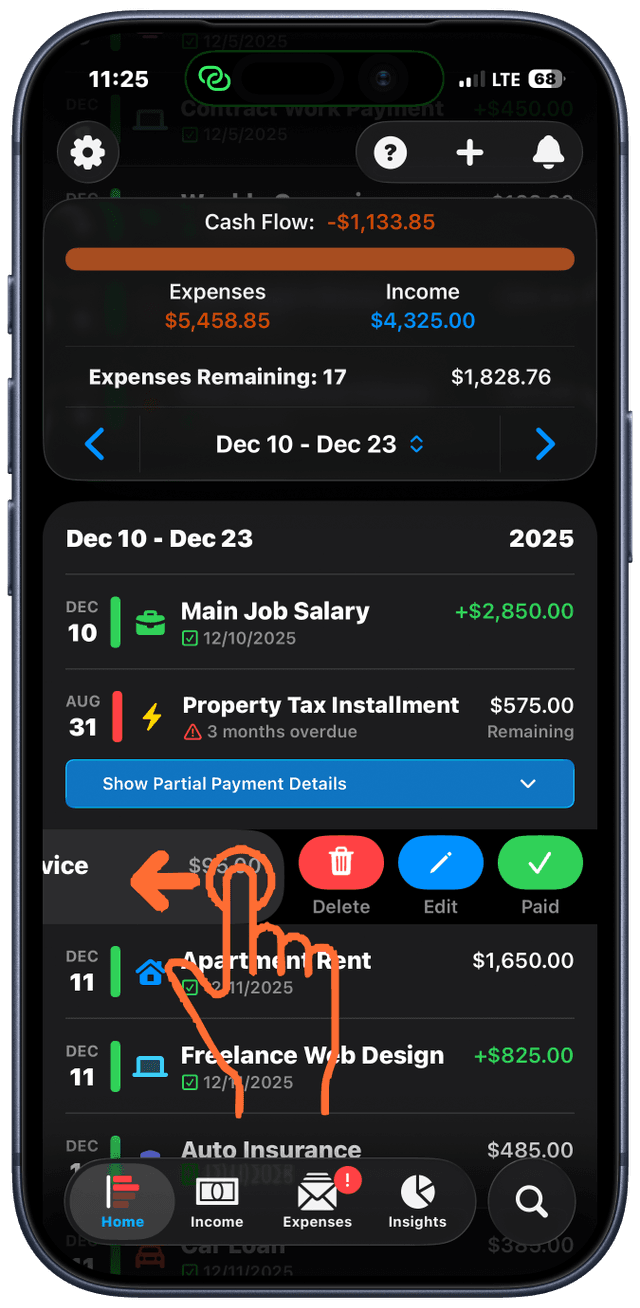

Editing & Deleting Transactions

Make changes to your income and expenses anytime.

Swipe left or long press on any item for quick actions

Tap "Edit" to open the edit form

Make your changes (amount, schedule, alerts, etc.)

Tap "Save"

Tips

- You can also tap an item to view its summary, then use the pencil icon to edit

- Delete option is also available in the swipe menu

- Changes update all future occurrences for recurring items

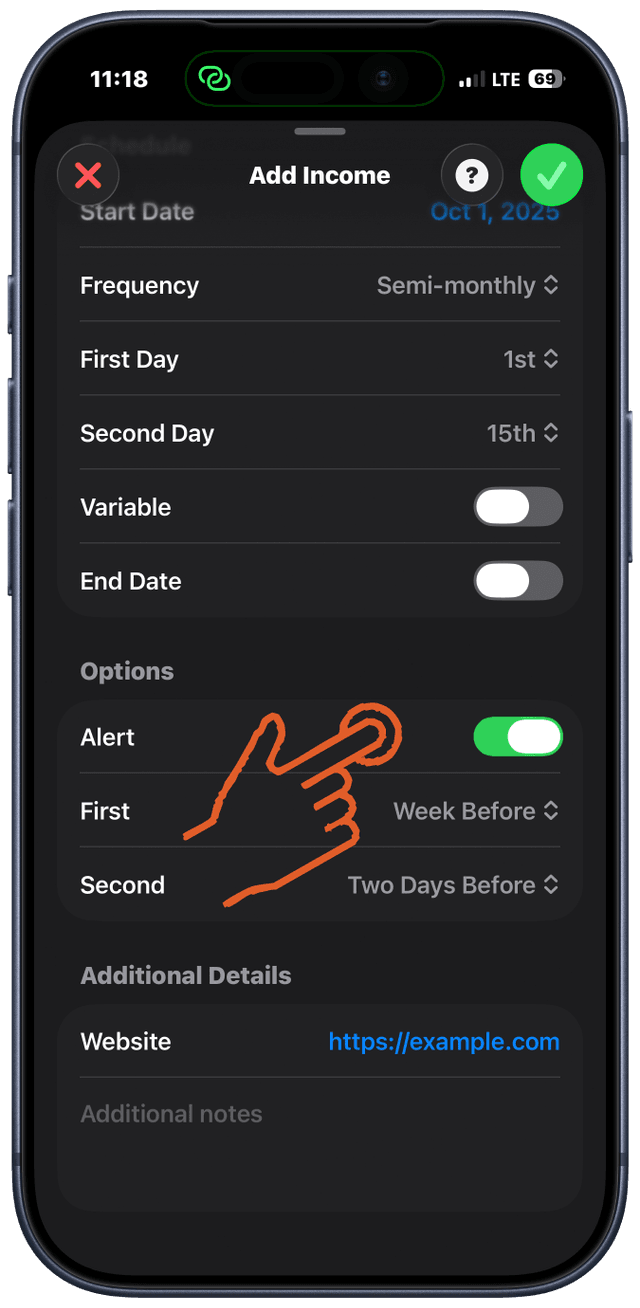

Setting Up Notifications

Never miss a payment with smart reminders.

Open Settings and enable system notifications

Or do this during onboarding

Edit any income or expense item

Scroll to the "Alerts" section

Choose up to 2 reminder times

Day of, day before, 2-3 days before, week before, two weeks before

Save your changes

Tips

- In-app notifications are always on and appear in the notification center

- System notifications can be disabled in iOS Settings

- Set alerts individually for each item

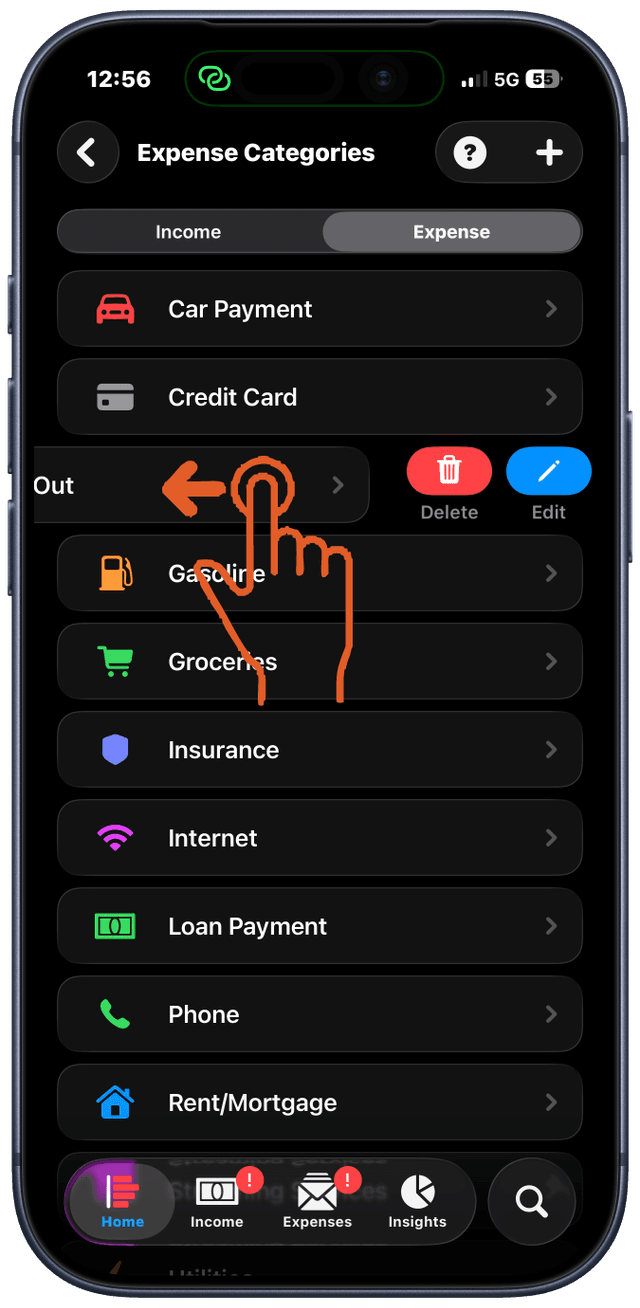

Managing Categories

Customize categories with custom icons and colors.

Go to Settings (gear icon)

Tap "Manage Categories"

Create new categories with "+" button

Choose an icon and color

Edit existing categories by tapping them

Delete unused categories by swiping left

Tips

- Income and expense categories are managed separately

- Categories help organize spending insights

- Create unlimited custom categories

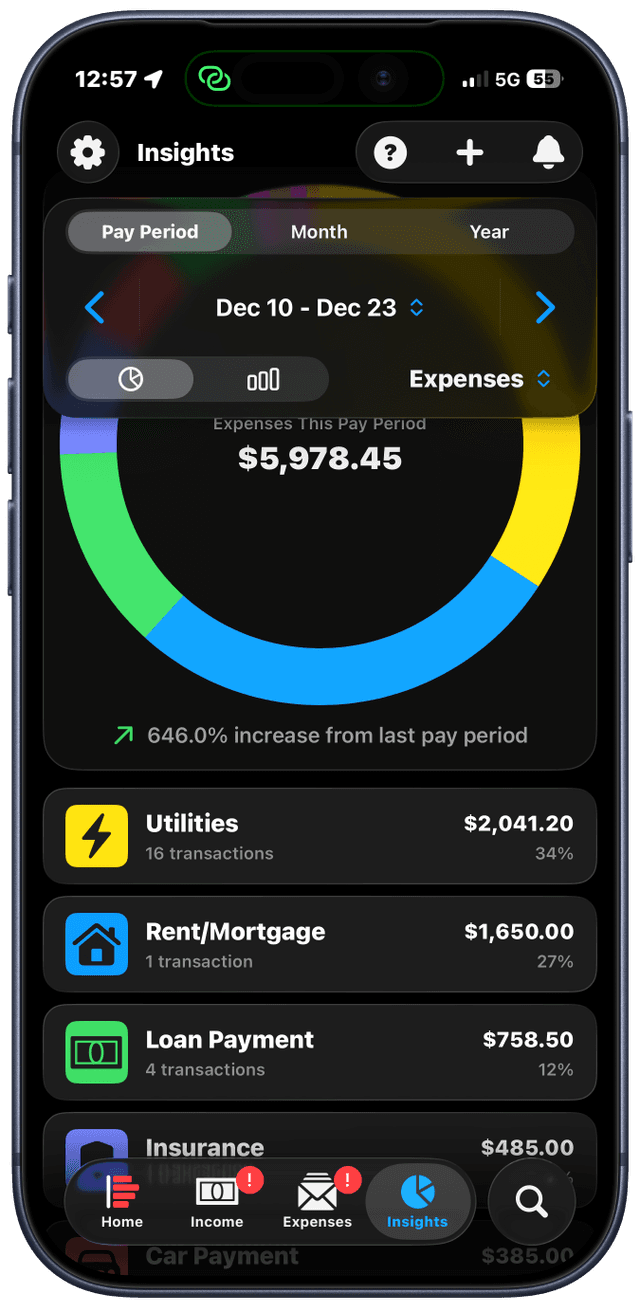

Viewing Spending Insights

Visualize your spending patterns with beautiful charts.

Tap the Insights tab at the bottom

View your spending breakdown by category

Toggle between time periods

Current pay period, month, or year

Tap categories to see detailed breakdowns

Tips

- Charts update automatically as you mark items paid

- Identify where your money goes each period

- Use insights to find opportunities to save

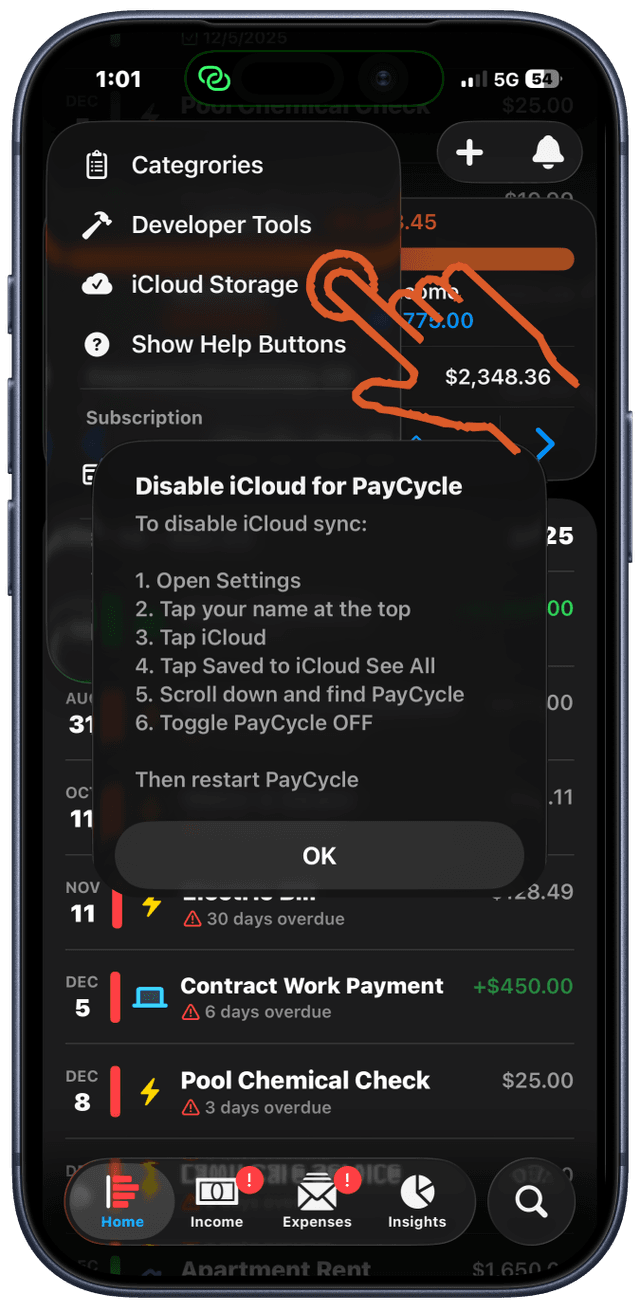

Privacy & iCloud Sync

Your data stays private and syncs across devices.

iCloud sync is enabled by default

Your data syncs automatically across all devices

To disable: Go to Settings > Toggle off iCloud Sync

Works offline - all data stored locally on your device

PayCycle never collects or shares your financial information. Everything stays between you and your iCloud account.

Tips

- Data is encrypted and only accessible by you

- Disable iCloud sync to keep data local to one device

- App works perfectly offline

Need More Help?

Check out our Q&A section for answers to common questions, or contact our support team at support@paycycle.info